What is the Solar Power Purchase Agreement (PPA)? A Solar Power Purchase Agreement (PPA) is a financial arrangement in which a solar company installs and maintains solar panels on a customer’s property and sells the electricity generated by the solar panels to the customer at a predetermined rate.

The solar service provider designs, builds, owns, operates, monitors, and maintains the solar panel system.

The purchase price of the generated electricity is typically below the retail electricity rate that the host customer would otherwise pay to their retailer.

Most PPAs have terms that can last ranging from 10 to 25 years. At the end of the PPA contract term, a customer may be able to extend the PPA, have the developer remove the system, or choose to buy the solar energy system from the developer.

PPA agreements allow the consumer to get around a lot of the conventional barriers to solar system installation. And it provides you access to the net metering benefits, allowing you to wipe out your utility bill.

PPAs Considerations

Upgrades and restructuring

Without a doubt, the developer is in charge of the installation, operation, and maintenance of a solar system.

To help with solar panel installation, lower installation costs, or comply with local regulations, the host customer might need to make improvements to their property.

For instance, fixing damaged roofs or trimming trees that block the sun’s energy may fall under this category.

SRECs

Solar Renewable Energy Credits (SRECs) display the amount of electricity produced using solar energy and are bought and sold, usually by load-serving entities or consumers for different purposes.

The solar developer most commonly owns SRECs in PPAs.

Before entering a Power Purchase Agreement (PPA), customers must understand who owns and can sell the SRECs produced by the Photovoltaic (PV) system.

Financing

The outright purchasing of a solar panel has several benefits, but different financing options should also be considered.

We will discuss all the solar financing options below.

Probable Increment in Property

with the potential of increased property value due to a PV system comes with a possible rise in property taxes, but the policies vary by state.

How Does a Power Purchase Agreement Work?

- Implement, develop, or re-finance a project with a PPA

- Determine the content of the contract. This includes details like the electricity price, contract duration, delivery terms, and any specific project-related considerations.

- Create an RFQ (Request for Quote)

- Compare the offers you received

- Negotiate the terms

- Sign the PPA contract

- Manage your energy sales and risk throughout the life of your asset

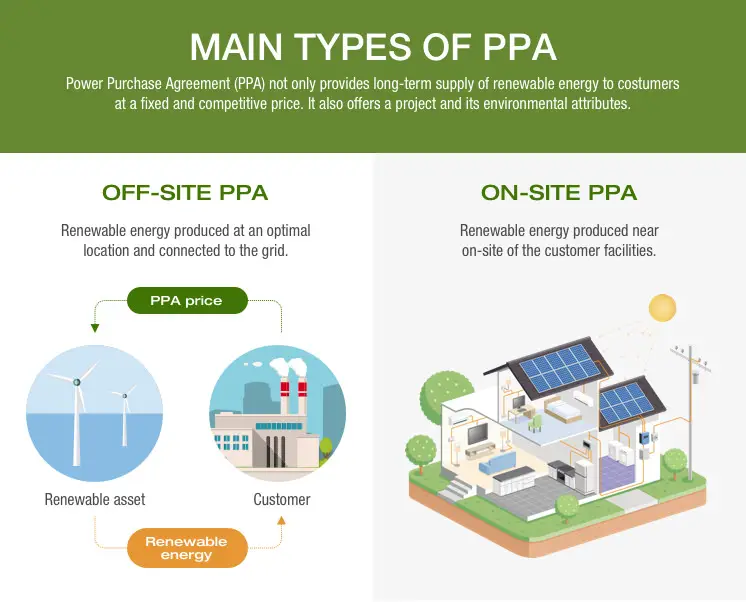

What Are the Main Types of PPA?

There are two types of PPA: on-site PPA and off-site PPA.

On-site PPA: Onsite Power Purchase Agreements (PPAs) are a contract between a project developer (and likely backed by a financial counterparty) and a retailer.

For a period of approximately 15 to 25 years, the project developer owns, runs, and maintains the renewable system.

Off-site PPA: Off-site PPAs are renewable energy contracts between a project developer and a company, where the RE installation is not sited at the location of the company’s electricity usage.

What Are the Benefits of Using PPA?

A Solar Power Purchase Agreement (PPA) offers several benefits, both for businesses and homeowners:

1. Cost Savings

One of the primary benefits of a solar PPA is the potential for cost savings.

Customers typically pay for the electricity generated by the solar panels at a rate lower than the local utility’s electricity prices and take advantage of net metering.

Typically, solar PV systems installed via a lease or PPA qualify for participation in net metering.

And this can lead to immediate savings on energy bills.

2. No Upfront Costs

With a solar PPA, the customer doesn’t need to invest in the purchase and installation of solar panels. The solar developer covers the upfront costs of the solar panel system, including equipment and installation.

3. Predictable Energy Costs

Solar PPA rates are often fixed or escalate at a predictable rate, allowing customers to budget for their energy costs with more certainty over the long term.

This can protect against rising utility prices.

4. Maintenance and Monitoring

Solar developers typically handle the maintenance and monitoring of the solar panels, ensuring optimal performance and reducing the hassle for the customer.

5. Environmental Benefits

Solar energy is clean and renewable, which helps reduce greenhouse gas emissions and dependence on fossil fuels.

By adopting a solar PPA, customers can reduce their carbon footprint and reap many other benefits in the future.

6. Long-Term Agreement

Solar PPAs often have long-term contracts, typically ranging from 10 to 25 years.

This stability can be appealing for businesses looking for consistent energy pricing over the long haul.

7. Scalability

Solar PPAs can be tailored to meet a customer’s specific energy needs.

As energy needs grow, additional solar panels can be added to the system to accommodate increased demand.

8. Energy Independence

Solar power generated on-site provides a degree of energy independence, reducing reliance on the grid and making customers less susceptible to power outages and disruptions.

Solar Financing Options

When you want to finance the installation of solar energy at your house, you should be aware of all your financing options, including —

- A Solar Power Purchase Agreement (PPA).

- A Solar Lease

- Conventional financing (a solar loan)

What Is the Difference Between a Solar PPA and a Lease?

Solar PPAs and solar leases both have a key difference in that neither provides a way to own the solar PV system that has been installed at your house.

Homeowners and renters must perform their own independent research and fully comprehend the terms and conditions of both solar PPAs and leases to prevent unexpected costs.

In a PPA, a developer covers the cost of a residential solar installation as part of the building process and then sells the solar energy to homeowners at a fixed price.

With solar leases, you make regular payments toward your solar panels and use the renewable energy they produce to lower your utility costs, just like when you lease a car.

Some solar contractors provide various plans for solar PPAs and leases, with costs that can range significantly.

The following are some major differences between solar leases and solar PPAs:

| Differences | Solar PPA | Solar Lease |

| Payment | Fixed price per kilowatt-hour (kWh) for power generated. | Fixed monthly ‘rent’ for using solar panels. |

| Term Length | 20-25 years | 10-25 years |

| Restrictions | A homeowner can neither own nor lease the solar PV system, and all solar renewable energy credits (SRECs) belong to the developers. | A homeowner can lease the solar panel and components. Negotiating to keep SRECs for yourself is possible. |

| Types | On-site/Behind-the-Meter PPAs/Retail-Sleeved PPAs/Virtual PPAs | Capital lease / Operating lease |

Is a Solar PPA and Lease Right for You?

Solar PPAs and leases are best for those who do not qualify for solar loans or do not own their homes.

But you can get the 26% federal tax credit by getting a bank loan or a specialized solar loan to pay for your solar system.

What Are the Drawbacks of Solar PPAs and Leases?

1. Third-party lease/ PPA partners

Your solar contractor may use third-party financing or lease/ PPA partners.

In these cases, you need to confirm that each company is financially healthy and has been in operation for an extensive period by conducting your independent investigation.

2. Third-party solar installation/ maintenance companies

It’s common to sign a solar PPA/lease with one company that then outsources the installation to a third party, while solar panels and equipment are owned by yet another company.

You must be informed of any possible issues with maintenance or solar panel cleaning services from all organizations engaged as a homeowner.

3. Hidden fees

There might be unfavorable lease or agreement terms that you weren’t aware of, as well as hidden upfront costs that third-party businesses pass along.

Before you sign an agreement, double-check all the important details.

4. Costs Vary

Based on your energy use with PPAs you only pay for the electricity you consume.

Leasing costs may rise annually along with utility rates, undercutting the planned savings.

5. Potential challenges with home sales

If you want to sell your home, the majority of PPA/lease companies allow you to transfer the installed solar PV system to the new owner.

Some buyers, though, might not be keen on buying a property with a rented solar system.

In this situation, you might need to pay early termination fees (ETFs) to get out of the lease or PPA arrangement.

6. No tax credits

You cannot claim solar tax credits or incentives because you do not own the solar PV system.

It belongs to the PPA or the leasing company.

However, installing a solar system often boosts your home’s value, which may increase your property taxes.

Given these drawbacks of solar PPAs and leases, it may be preferable for you to pay for installing your PV system using conventional financing methods, such as a solar loan or a home equity line of credit (HELOC).

Why Conventional Financing Is A Better Option?

The advantages of financing a solar PV system outweigh those of leasing or PPAs.

The following are some of the main benefits of solar financing:

Reduced lock-in period: Unlike solar loans, which are typically repaid in under 12 years, PPAs and leases lock you into a 20–25-year contract.

Tax incentives: Since you are purchasing a solar panel system directly, you are possibly entitled to a federal investment tax credit (ITC) and other federal or state tax incentives.

Zero Down Payment: If you work with the appropriate solar provider, you could qualify for solar loans with zero down payment and zero interest.

Acquiring the Solar PV system: At the end of a lease or PPA, you can purchase the system at fair market value or request the lease or PPA companies to be removed from your roof.

The value of your property will grow if it is equipped with a solar-powered PV system, nevertheless, once you have paid off the solar loan.

It is crucial to keep in mind that installing a solar energy system is a considerable investment that might influence your short-term and long-term finances as you calculate the best solution for your needs.

You may get unbiased advice on going solar and the best option to suit your needs from an expert solar installer.